George Soros' Reflexivity Theory

How positive and negative feedback loops not only affect stock prices but also companies' fundamentals and how a trend quickly can turn into a bubble.

George Soros is perhaps best known as "The man who broke the Bank of England" when he made a £1 billion profit in a single day by shorting the pound sterling on what is now referred to as "Black Wednesday".

With the madness going on in today's markets, I keep thinking of George Soros’ ‘General Theory of Reflexivity’: How positive and negative feedback loops not only affect stock prices but also companies’ fundamentals and how a trend quickly can turn into a bubble.

Feedback Loops

Reflexivity provides an understanding of how asset bubbles work and is based on two main principles:

Market prices distort the underlying fundamentals

Financial markets have an active role in influencing the fundamentals that they should simply reflect.

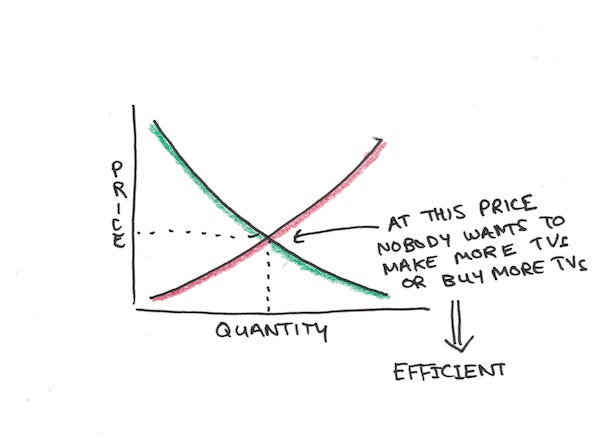

These principles contradict the efficient market hypothesis which states that market prices reflect all available information. According to Soros, behavioural economics is on the right track but only takes the first principle into account.

So, what is reflexivity? According to Soros there are two types of feedback loops that characterize financial markets: negative and positive.

Negative feedback loops are self-correcting while positive feedback loops are self-reinforcing. Negative feedback loops goes towards balance (equilibrium) while positive feedback loops goes towards imbalance (non-equilibrium).

Soros regards positive feedback loops as more interesting since these can cause large movements in both market prices and the underlying fundamentals. A positive feedback loop is initially self-reinforcing but will eventually reach a climax and a turning point where it becomes self-reinforcing in the opposite direction.

Note that positive feedback loops do not always run it’s course but can be interrupted at any time by intervention (e.g. regulation) or by negative feedback.

An example of a negative feedback loop - oil prices:

A decade ago when oil prices were high, many chose to reduce their oil usage when at the same time oil companies were investing in fracking / off shore due to the high profitability of oil.

The high oil prices caused a reaction which increased supply while also decreasing demand which resulted in oil prices falling over time.

Today, the oil price is low and we see the opposite happening. Many do not hesitate to use oil at the same time as oil companies reduce production due to falling profits. This negative feedback loop can be seen as a stabilizing force that causes a mean reversion in assets.

An example of a positive feedback loop - Amazon:

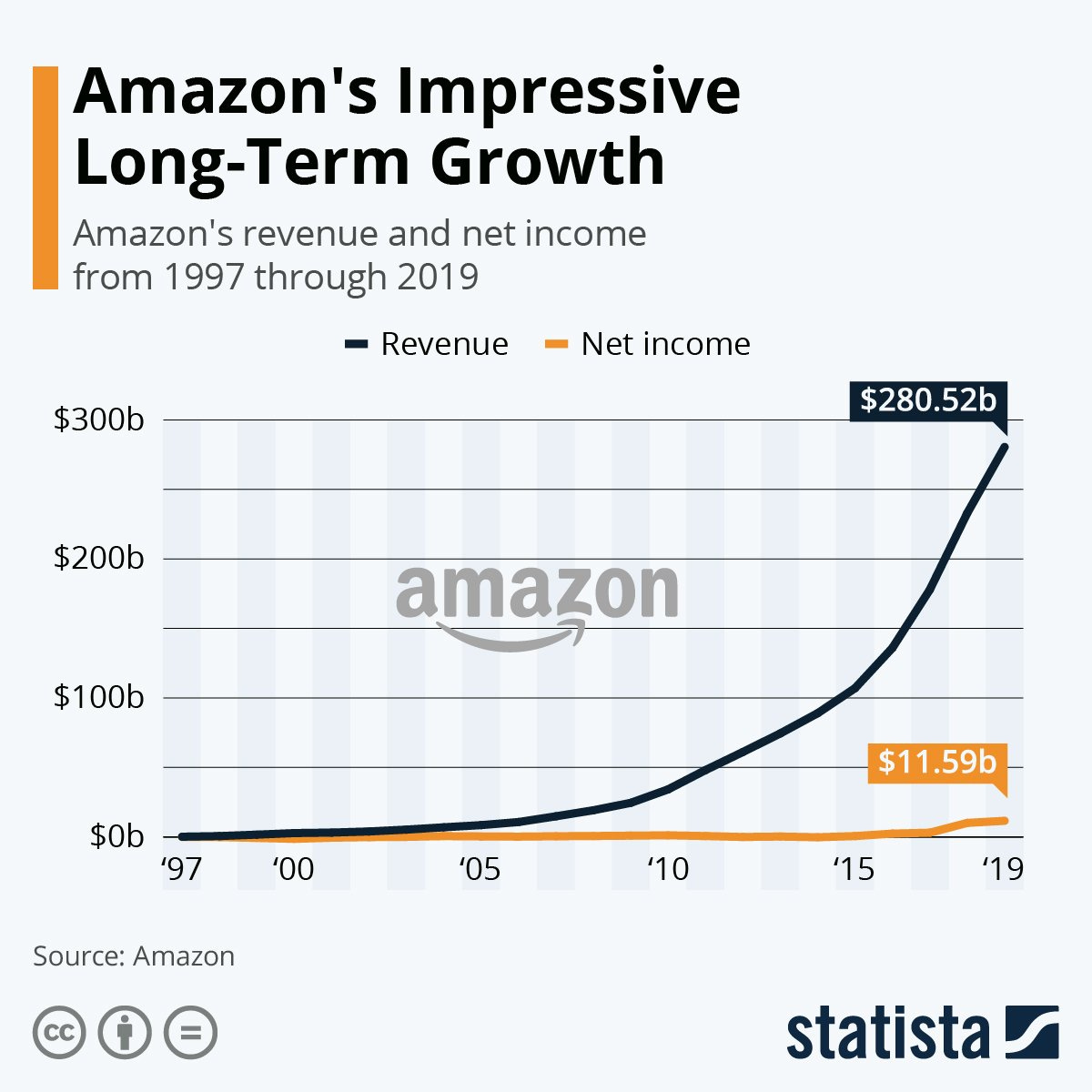

Jeff Bezos used the IT craze of the late 1990’s to raise an almost unlimited amount of cheap capital and thus enabling the continued growth of the company. As Amazon grew they attracted even more cheap capital which allowed the company to grow even more.

Unlike other retailers who were forced by their investors to show profits, Amazon was able to burn capital in the pursuit of growth. This allowed Amazon to be extremely aggressive with pricing which drove away competitors and resulted in even more growth for Amazon.

In 2006 Amazon Web Services (AWS) was launched and a decade later it was the most profitable division at Amazon. Without a positive feedback loop the core business (e-commerce) could not have grown in the same manner and over time pivoted into other areas with better margins.

No investor would have thought that Amazon would become one of the world's largest cloud companies at IPO (maybe the world’s largest bookstore), but the positive feedback loop opened up for this opportunity, something that is entirely possible under Soros' reflexivity framework.

The boom/bust cycle

Soros further claims that bubbles have two key components:

An underlying trend that can be observed in the real world and

a misconception related to that trend

A boom / bust cycle starts when the underlying trend and the misconception end up in a positive feedback loop. If the reflexive loop is strong enough, both the trend and the misconception will be self-reinforcing.

Sooner or later market expectations will be so decoupled from the fundamentals that investors can no longer turn a blind eye to reality. This is when a "twilight period" occurs: doubts grow and more and more people lose faith, but the trend can still continue due to inertia. But in the end, the trend reverses and becomes self-reinforcing in the opposite direction.

According to Soros, bubbles are asymmetric. The boom is long and drawn out, slow to pick up speed and gradually accelerates until it ultimately flattens out during the twilight period. The bust is fast and steep because it is enhanced by forced liquidation of leveraged positions. Doubt turns to panic which reaches its climax in a financial crisis. The length / strength of each stage is unpredictable but there is an internal logic to each stage.

The real estate cycle

The real estate cycle is a typical boom / bust cycle. The initial trend in the real estate boom is that credit becomes cheaper and easier to obtain. The misconception that turns the trend into a bubble is the belief that the value of real estate is not related to the availability of credit.

As real estate values rise, property owners receive a higher credit rating and can borrow more with their assets as collateral. The relationship between the availability of credit and the value of the collateral is thus reflexive.

Cheaper / easily available credit also means increased economic activity. This means fewer bankruptcies, lending standards are eased etc. At the peak of the boom, the amount of leverage will be at its highest and a reversal in the trend means rapid forced liquidation which quickly devalues real estate.

Since the majority of loans are secured by real estate (the asset banks are most willing to lend against), boom / bust cycles in real estate are common.

According to Soros, a rising bubble is not the right place to short. When he sees that a bubble is starting to take shape, he hurries to buy, "adding fuel to the fire", but is at the same time ready to change his positioning when the markets turn.

Did you enjoy this newsletter? Please subscribe if you haven’t already!

Original tweet from 28 January 2021: